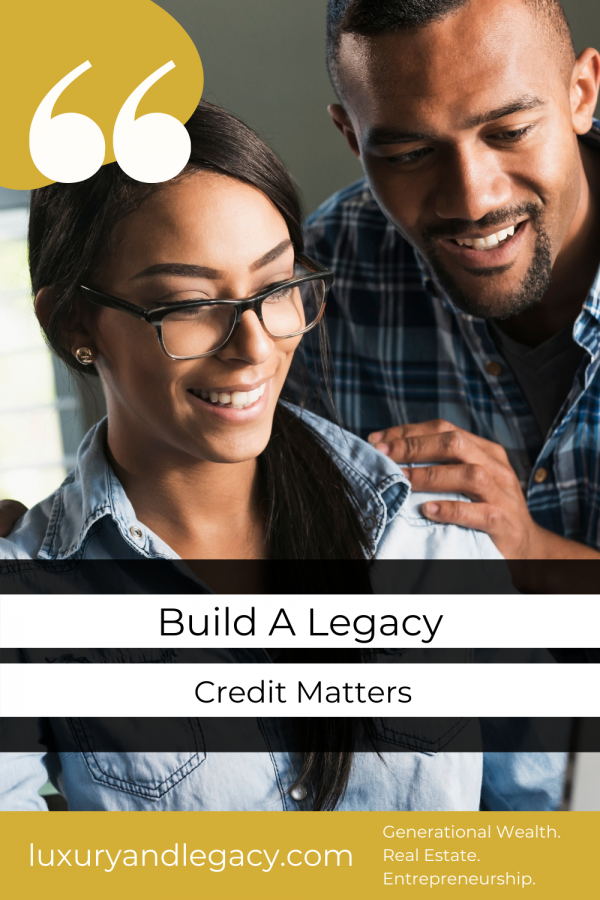

20 Jun Build A Legacy: Credit Matters

Have you ever considered that everything we do in life comes down to numbers? This explains why credit matters so much. From the 9-digits we’re issued at birth, that stubborn 10lbs. we want to lose, and those 3 numbers that gauge our worthiness to buy a home, establish a business, and build a legacy. Credit, and more importantly how you manage it, is everything.

Credit is the amount of money you are allowed to borrow with the understanding that it will be paid back. It is your purchasing and borrowing reputation, and it follows you from the first account you open until the last payment is made. And even after that. Credit cards, student loans, and mortgages are all forms of credit. But what are the different types of credit?

The 4 Types of Credit

The four types of credit include revolving credit, installment credit, charge cards, and non-installment or service credit. Let’s break each of these down and discuss the differences.

Revolving Credit allows you to borrow a certain amount of money, also known as your credit limit. The money borrows “revolves” meaning the balance rolls from month to month until paid. Revolving credit is the most common form of credit issued. Mastercard, Visa, Discover, and some retail stores offer revolving credit cards to their customers.

Installment Credit is where you have a set amount that you can borrow, as well as, a set monthly payment. There is also a strict payment structure that must be adhered to. Forms of installment credit can include mortgages and auto loans. In addition, installment credit typically requires some form of security or collateral. Failing to pay back the loan means the lender can confiscate the collateral.

Charge Cards are not the same as revolving credit cards, which is something people often get wrong. A charge card must be paid in full each month. Failing to pay the balance will result in additional fees (or penalties) being applied to the balance. An example of a charge card is American Express.

Non-Installment or Service Credit allows you to pay for a service at a later date. Mobile phones, utilities, and gym memberships are types of service credit. Failing to pay your bill results in the service being turned off or canceled until payment is made.

What is a Good Credit Score?

Your credit score is a 3-digit number that translates into how well you manage your credit. Credit scores range from 300-850, with a high number meaning you are creditworthy. Your credit score is calculated by the information listed on your credit reports. Companies send details about late payments, defaults, and a host of other concerns to the top three reporting agencies, Experian, Equifax, and TransUnion.

Scores ranging from 580 to 669 are generally considered fair; 670 to 739 are good; 740 to 799 are very good; and 800 and above are considered excellent.

The higher your credit score, the more confidence a lender has that you will pay back your loans on time.

What Determines Your Credit Score

As I mentioned, lenders send information to the 3 credit reporting agencies which makes up your credit report. There are several factors that lenders report on. These factors include:

- Amounts Owed

- Payment History

- New Credit

- Credit History Length

- Credit Mix

All consumers are allowed to request 1 free annual credit report from each of the credit reporting agencies. To obtain your free credit report, visit annualcreditreport.com

When reviewing your credit reports, make sure the information is accurate. If you see something that looks wrong, contact the company/lender and ask for clarification. Take the necessary steps to have any false information corrected.

One factor to be mindful of is identity theft which is when someone opens an account under your name without your permission.

why credit matters

Managing your credit requires attention to detail, patience, and determination. It is necessary to get a handle on your credit when it comes to building a legacy. The last thing you want is to have past credit issues hinder the plans you’ve set up for your family.

Remember to pay your bills on time; keep your balances low; watch out for credit scams; and protect your personal information. For help, consider reaching out to a professional credit counselor who can walk you through the steps of building or rebuilding your credit.

📌 SHARE ON PINTEREST

Recent Post By Luxury + Legacy

-

17.05.2022

Let’s Talk About Stress, Baby!

In respect of Mental Health Awareness this month, I decided to shed some light on a topic that many consider to be taboo. Stress. Anxiety. Depression. While often regulated to a single occurrence, we are now seeing the large scale impact throughout society....

Building A Legacy Entrepreneurship Luxury and Legacy Michelle Morton Realtor No comment -

18.03.2022

Build A Legacy: Black Business Showcase

During Black History Month, I had the pleasure of highlighting four amazing businesswomen. They are part of the Luxury + Legacy family, and each are thriving in their specific industries....

Building A Legacy Entrepreneurship Estate Planning Generational Wealth Luxury and Legacy Michelle Morton Realtor No comment -

12.11.2021

Build a Legacy: By Buying Real Estate

Understanding the buyer's journey of investing in real estate is one thing. Overcoming the fear and hurdles is another. This is why we do what we do....

Building A Legacy Buying a Home DMV Luxury Homes Estate Planning Generational Wealth Luxury and Legacy Michelle Morton Realtor Real Estate No comment

[…] […]